What's new

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

They say a change is as good as a holiday.

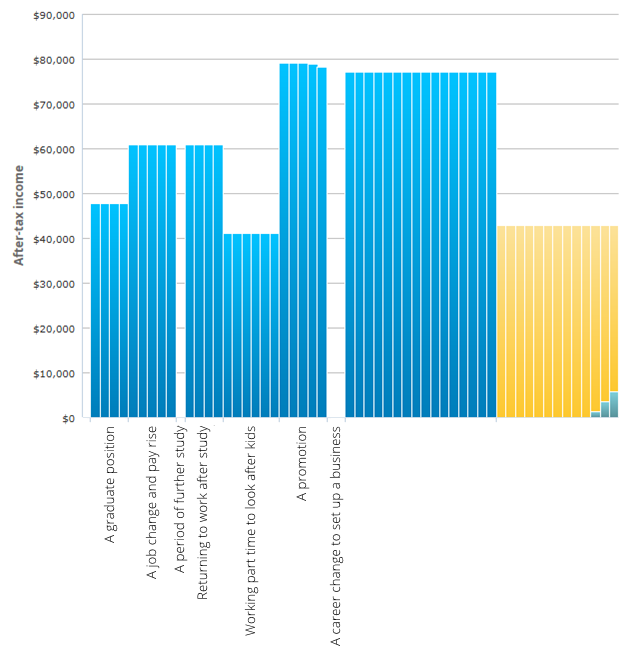

The Retirement Income Simulator can now cater for both in relation to your career. The new career change feature allows you to specify up to three points at which your salary might experience a step-change. This allows for a promotion, a job change or even a period of part time work. The Simulator has always had a career break feature, where you can model up to three periods of no salary and contributions. Combine the two and you can now allow for something like this:

If you’re really into it, you can do the same for your partner as well.

Tags:

retirement-planning

career

Happy New Year!

For our Australian clients:

ASIC is reviewing the regulations applying to online calculators, which are due to expire 1 April 2016, but our clients needn’t be concerned. Let me explain.

The Australian Securities and Investments Commission (ASIC) is the regulator responsible to protect consumers when they make decisions and transactions in relation to financial products. One of the areas ASIC operates in is the area of financial product advice. Providers of financial product advice need to be licensed, and comply with various provisions in the Corporations Act, and breaching these provisions carries serious penalties. On the face of it, an online calculator like the Retirement Income Simulator could be considered to be providing financial product advice because it can be used to make decisions about superannuation – how much to contribute, investment strategy, amount to draw down etc, and also because it includes default assumptions about investment returns and inflation.

ASIC sees the benefits online calculators offer to consumers, so has set some simplified rules that allow funds to provide calculators without the requirement to be licensed and comply with the provisions in the Corporations Act. These rules relate to:

The rules have been in place for 10 years and are about to expire, so ASIC has issued a consultation paper and proposed some minor changes.

What will this mean for your Retirement Income Simulator? We will be making a submission as part of the consultation process, and will be informed of the new rules and any transition period. (If you are a client offering a calculator, or even a calculator user, you could consider making a submission as well.) We will ensure that our calculators remain compliant with regulations at all times and will consult our clients on the implementation of any required changes. The licence fee for the RIS covers changes required for external events such as regulatory change. Please contact us if you have any queries.

Tags:

regulations

ASIC

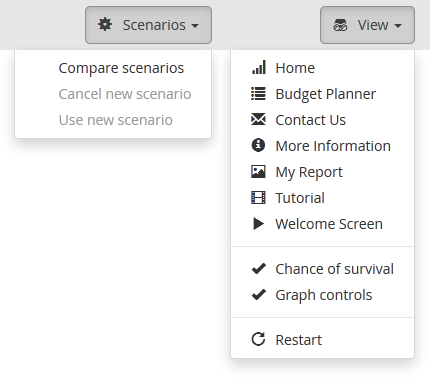

Today’s release includes the following new features:

We also welcome new client Virgin Money Australia with today’s release.

Tags:

retirement-planning

retirement-age

age-pension

compare-scenarios

pdf

When we designed the Retirement Income Simulator, we decided to use sliders for the majority of our inputs. The upside of this was that it made entering details easy on a wide range of devices with little margin for error. The downside, however, is that is often not possible to enter exact information using the sliders, and users are forced to use the nearest possible value on the slider.

Our most recent update adds a new method of input to the Retirement Income Simulator. By clicking or tapping on the amount displayed above a slider, users can now enter their exact details in a text box.

This allows the Retirement Income Simulator to generate projections that are much more relevant to users' exact conditions. In addition, users accessing the secure version of the Simulator will now find that it is pre-populated with their exact salary and super balance instead of rounded amounts.

Tags:

retirement-planning

updates

user-interface

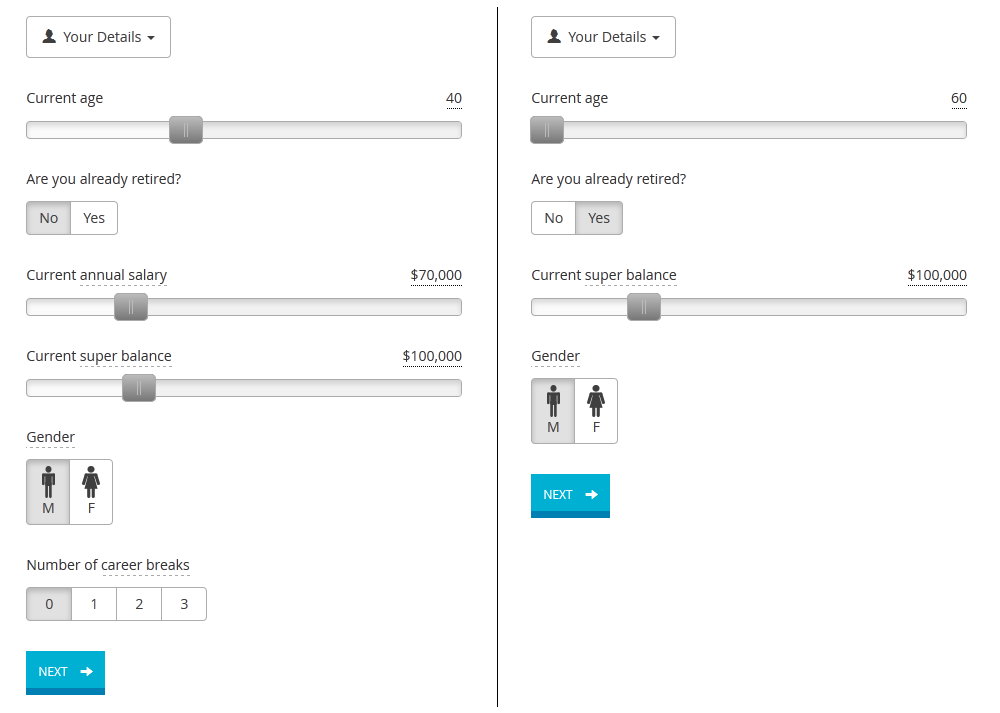

As more and more people retire and take account based pensions, we have seen an increasing demand for the Retirement Income Simulator to present itself in the best way for the retirement phase. Once you’ve retired, inputs such as salary, contributions and career breaks are irrelevant. The only levers you’ve got are desired income and investment strategy.

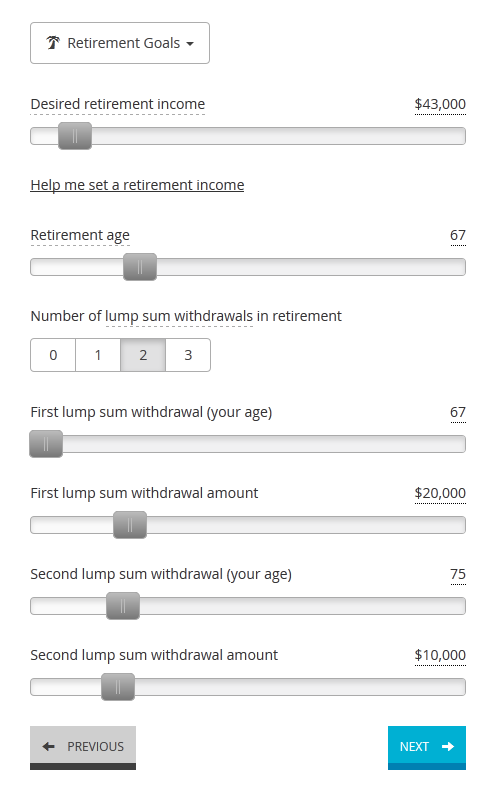

So if you answer ‘Yes’ to ‘Are you already retired?’, you’ll get a simpler user interface. And instead of a lump sum drawn at retirement, you can specify multiple lump sum withdrawals at and during retirement.

Tags:

retirement-planning

updates

user-interface