What's new

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

Effective 20th September 2015 the maximum Age Pension has been increased to $867 per fortnight for singles and $1,307 per fortnight for couples. This is around a 0.8% increase from the previous figures which were last updated in March 2015.

Indexing of the means test and deeming thresholds is now with inflation (CPI) rather than wage growth. In the past we prioritised simplicity by using a single indexer/deflator (wage growth), but in reality these thresholds are indexed with CPI. This makes more difference for those retiring in the longer term than now. See our previous post.

We have also updated the budget planner with the June 2015 (latest available) ASFA Retirement Standard figures to fund a comfortable standard of living for those entering retirement. More details about the standard can be found here.

Tags:

retirement-planning

asfa-retirement-standard

age-pension

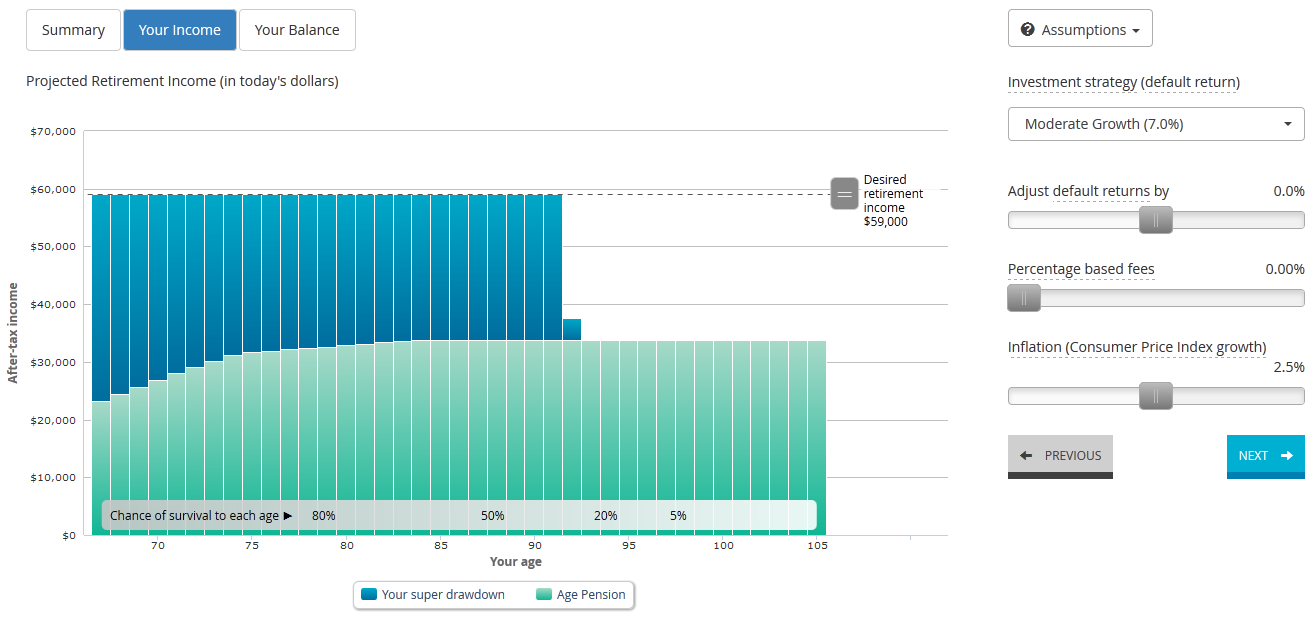

You might be aware that ASFA maintains a quarterly survey of the cost of living in retirement. Dividing retirees’ expenditure into categories, ASFA finds that a retiree couple who want to live comfortably need approximately 59,000 per year. There are other flavours of the standard (for singles, for a modest standard of living, and for the elderly), but I’m most interested in the comfortable couple scenario.

If you take the ASFA income amount as what you need each year, the obvious question is ‘what level of savings is required to support that income for a known period?’ This opens the proverbial can of worms, because it depends on many assumptions about the future – what return will you earn in retirement, what will inflation do, how much age pension will you receive and so on? And people have been asking what the impact of the new assets test from 2017 will be.

Anyway, it turns out that not only does it depend on assumptions about the period in retirement, but also on when you plan to retire. In particular, people about to retire will need less than those planning to retire in 10 years, even allowing for converting these amounts to today’s dollars. ASFA have recently said that a couple needs $640K to get 25 years of income in retirement, and that’s right if you plan to retire in 2040. For those retiring now, around $500K will deliver the same expected income.

Why the difference? It’s all in the age pension means tests, and how you convert future dollars to today’s dollars. The means tests work by reducing your pension for any assets or income over certain thresholds. For example, a couple loses 50c of pension for every dollar of income they earn over a threshold amount of around $7,500 per year. These thresholds are indexed (increased each year) in Australia with price inflation, or CPI. But when we convert these to today’s dollars we use wage growth, which is higher than CPI, so in today’s dollars they are reducing over time. In 25 years’ time, you will be penalised for holding a smaller amount of assets than you would today, and hence you need more of your own super to cover the shortfall in age pension.

In the Retirement Income Simulator, we have kept things simple up to now by assuming that the thresholds are indexed at the same rate as we use to convert to today’s dollars. But as the simulator evolves, we are able to make it more sophisticated, so the latest release includes CPI indexation of the means test thresholds.

For the record, here are the assumptions, I’m using for my $500K now:

Here’s what it looks like in the Retirement Income Simulator.

And if you’re really interested in all the details, here’s the report for this scenario.

Tags:

retirement-planning

asfa-retirement-standard

On 22 June the Parliament passed the Fair and Sustainable Pensions Bill, increasing the full pension asset range by up to 31% (couples) but slashing the part pension asset range by around 48% from 1 January 2017. We have included this in the 1 July release assuming the new taper rate and the present value of the new assets thresholds are applicable now. We suggest all RIS users review their retirement plans in light of these changes:

| As at 30 June 2015 | From 1 January 2017 | |

| Single home-owner asset threshold | $202,000 | $250,000 |

| Single not home-owner asset threshold | $348,500 | $450,000 |

| Couple home-owner asset threshold | $286,500 | $375,000 |

| Couple not home-owner asset threshold | $433,000 | $575,000 |

| Asset taper rate | $1.5 per fortnight for every $1000 of assets over threshold | $3 per fortnight for every $1000 of assets over threshold |

We all tend to glaze over when presented with those necessary but dense T&Cs. Well the RIS has had a front page makeover, and here is the same content but presented better. Four important things you need to know about using the RIS, but a simple icon and a brief heading gets the message across more effectively.

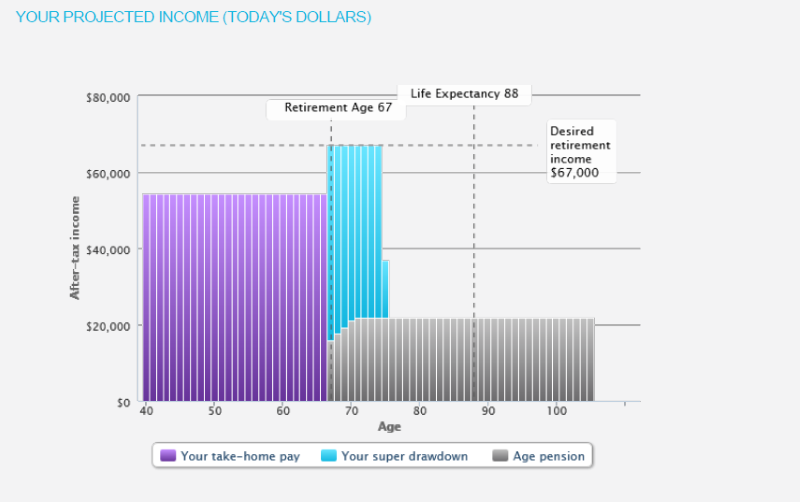

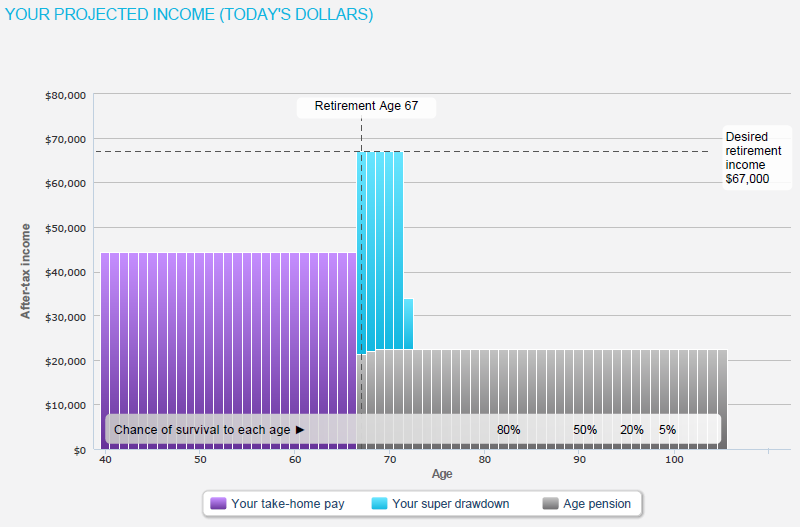

We’ve also changed the way charts get incorporated into the PDF. Previously we converted the chart to an image before putting them onto the pdf. However now we re-create the chart on the server and add it into the PDF. You can see the differences in the following two images:

after:

after:

Notice how much sharper the text is - if you zoom in on the PDF text it will now be crystal clear, no matter the size.

before: after:

after:

This also means that printing your PDF will give you a much better quality printout.

This also means that printing your PDF will give you a much better quality printout.

Tags:

retirement-planning

pdf

updates

terms-and-conditions

age-pension

government-co-contribution

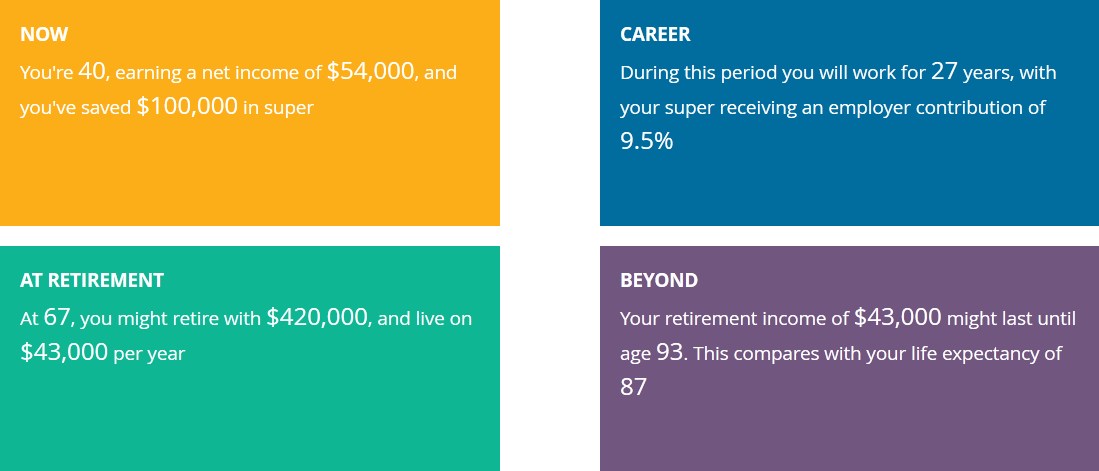

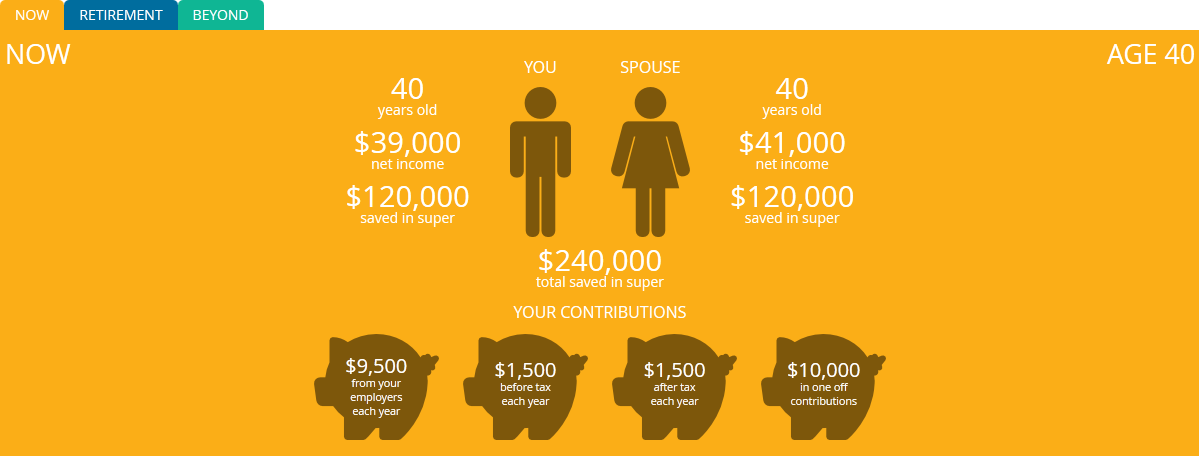

The Retirement Income Simulator’s summary screen is a great way to get a high level view of your future, and today it’s received a substantial visual upgrade. We’ve gone from simple blocks of text:

…to something a bit more visually engaging:

The new summary screen contains all the same information as the old screen, as well as some new features. Now you can see an estimate of the chance of outliving your super, and an explanation of how changes you’ve made using the compare scenarios feature could affect your retirement.

You can try the new summary screen in our live demo.