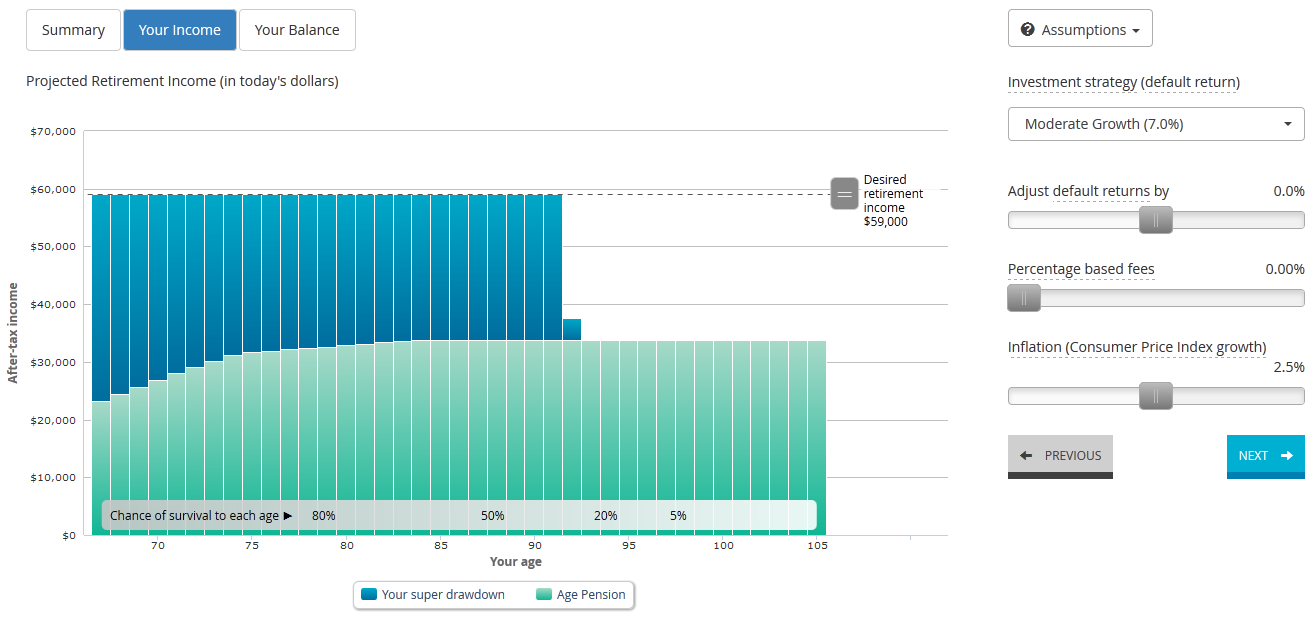

You might be aware that ASFA maintains a quarterly survey of the cost of living in retirement. Dividing retirees’ expenditure into categories, ASFA finds that a retiree couple who want to live comfortably need approximately 59,000 per year. There are other flavours of the standard (for singles, for a modest standard of living, and for the elderly), but I’m most interested in the comfortable couple scenario.

If you take the ASFA income amount as what you need each year, the obvious question is ‘what level of savings is required to support that income for a known period?’ This opens the proverbial can of worms, because it depends on many assumptions about the future – what return will you earn in retirement, what will inflation do, how much age pension will you receive and so on? And people have been asking what the impact of the new assets test from 2017 will be.

Anyway, it turns out that not only does it depend on assumptions about the period in retirement, but also on when you plan to retire. In particular, people about to retire will need less than those planning to retire in 10 years, even allowing for converting these amounts to today’s dollars. ASFA have recently said that a couple needs $640K to get 25 years of income in retirement, and that’s right if you plan to retire in 2040. For those retiring now, around $500K will deliver the same expected income.

Why the difference? It’s all in the age pension means tests, and how you convert future dollars to today’s dollars. The means tests work by reducing your pension for any assets or income over certain thresholds. For example, a couple loses 50c of pension for every dollar of income they earn over a threshold amount of around $7,500 per year. These thresholds are indexed (increased each year) in Australia with price inflation, or CPI. But when we convert these to today’s dollars we use wage growth, which is higher than CPI, so in today’s dollars they are reducing over time. In 25 years’ time, you will be penalised for holding a smaller amount of assets than you would today, and hence you need more of your own super to cover the shortfall in age pension.

In the Retirement Income Simulator, we have kept things simple up to now by assuming that the thresholds are indexed at the same rate as we use to convert to today’s dollars. But as the simulator evolves, we are able to make it more sophisticated, so the latest release includes CPI indexation of the means test thresholds.

For the record, here are the assumptions, I’m using for my $500K now:

Here’s what it looks like in the Retirement Income Simulator.

And if you’re really interested in all the details, here’s the report for this scenario.