What's new

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

Keep up-to-date with the latest improvements to all of our Retirement Income Simulator products

Two excellent new features in the Retirement Income Simulator are available now.

It is now possible to model a combination of investment options in the Retirement Income Simulator, by using the new 'Custom strategy' feature. We recognise that many super fund members have their savings in a combination of products, and having to choose a single option to use the RIS was a limitation for these customers.

On the Assumptions panel you can now select 'Custom' and enter percentages against each investment option, ensuring they add to 100%. This will then show the expected return for the combination strategy in the option menu.

We have limited this feature to the pre-retirement phase for now, and you can't combine with a Lifecycle option.

We have also changed the way voluntary contributions are set. Instead of setting both after-tax and salary sacrifice contributions on sliders, the user now sets the total voluntary contribution in after-tax dollars and the Simulator allocates between after-tax contributions and salary sacrifice contributions in a way that maximises the Government co-contribution and avoids breaching the concessional contribution cap. You can also select to manually allocate contributions as per previous functionality.

Tags:

investment

assumptions

contributions

Following further reductions in the RBA cash rate, the Government amended the income test deeming rates to better reflect what retirees might actually earn on deposits. The deeming rates are used to calculate notional income on investment assets (including super savings in retirement phase), which in turn counts against the income test threshold for the Age Pension. The new lower rate of 1% p.a. and upper rate of 3% p.a. have now been applied in the Simulator.

Tags:

updates

Today we released the updated Retirement Income Simulator for the 2019-20 financial year. There were no changes to the underlying calculations, just parameter updates as follows:

We have chosen not to include the Low Income Tax Offset and Low and Middle Income Tax Offset at this stage, based on their relative size and the fact that they have no impact on super. If proposed changes now before Parliament are passed, we will review this decision. At present we are also considering modelling future income tax threshold changes that will occur from 2022. All of the changes impact after-tax income only, so are secondary to the purpose of the simulator.

Tags:

updates

Today, ASIC released regulations that allow super and retirement calculators to allow for increases in community living standards. Our previous post on this topic noted that ASIC had mandated using a 2.5% p.a. discount rate to convert future dollars to today's dollars, with a time-limited exemption for super and retirement calculators. Since then the exemption was extended twice, but we now have certainty about how we present today's dollar amounts.

We allow our clients to use inflation rates that are consistent with the default investment returns. The additional factor over price inflation that allows for increases in community living standards is usually between 1% and 1.5%.

No changes are required for the Retirement Income Simulator because it already allows for increases in community living standards, and discloses this.

Tags:

regulation

inflation

assumptions

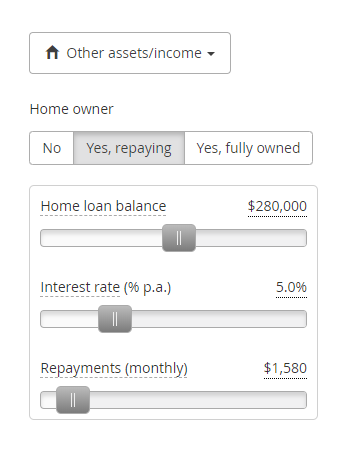

We have just added a much requested feature! You now can now model your home loan inside the "Other assets/income" panel:

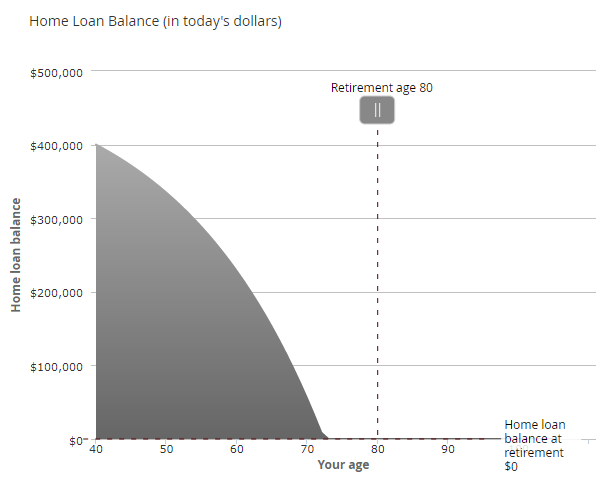

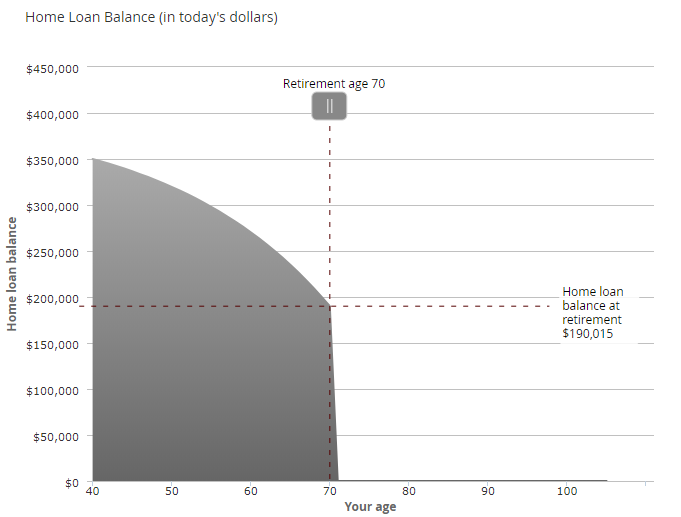

By selecting Yes, repaying you'll get a nice graph showing your home loan balance:

The good news is that if your home loan is paid off before retirement, then everything works much the same as it always has.

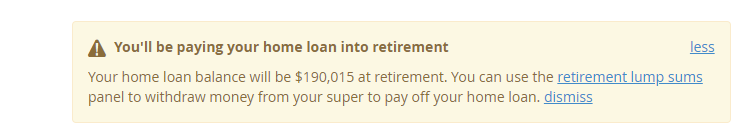

However, if your home loan is not paid off by retirement, then you'll see a notification:

Which will hopefully set off some alarm bells!

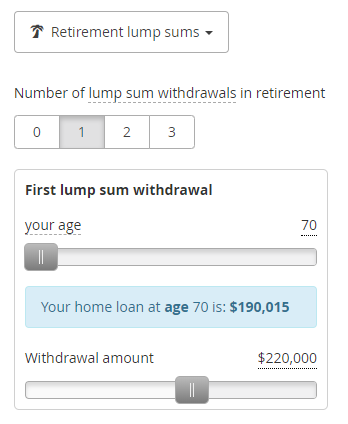

If you want to pay off your home loan when you retire, you can use the "Retirement Lump Sums" panel:

This allows you to assign a lump sum withdrawal to pay off your loan, so you can see where you stand for retirement.

If you were to withdraw a lump sum to pay off your home loan, you can see it reflected in the home loan graph:

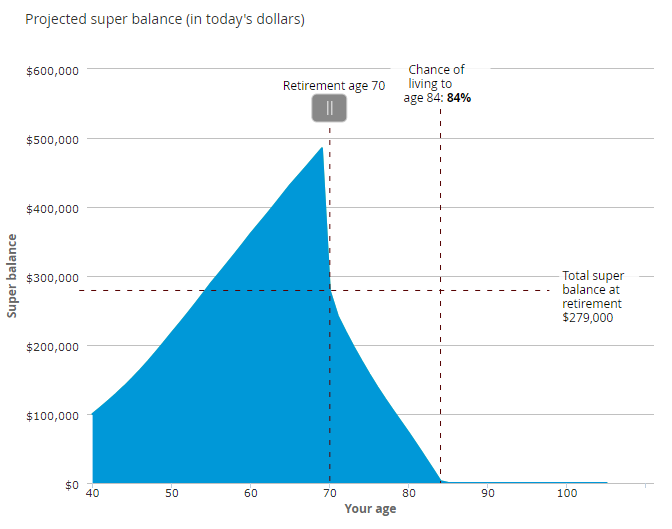

And of course, this is then reflected in your super balance :

We hope that this new feature makes the calculator even more flexible and gives you options for planning for your retirement. If you have any queestions don't be afraid to contact us.

Tags:

homeloan

newfeature

mortgage