Retirement Income Simulator

Detailed retirement income projections in seconds, making retirement planning simple on the web, in the mailbox or in the boardroom

Detailed retirement income projections in seconds, making retirement planning simple on the web, in the mailbox or in the boardroom

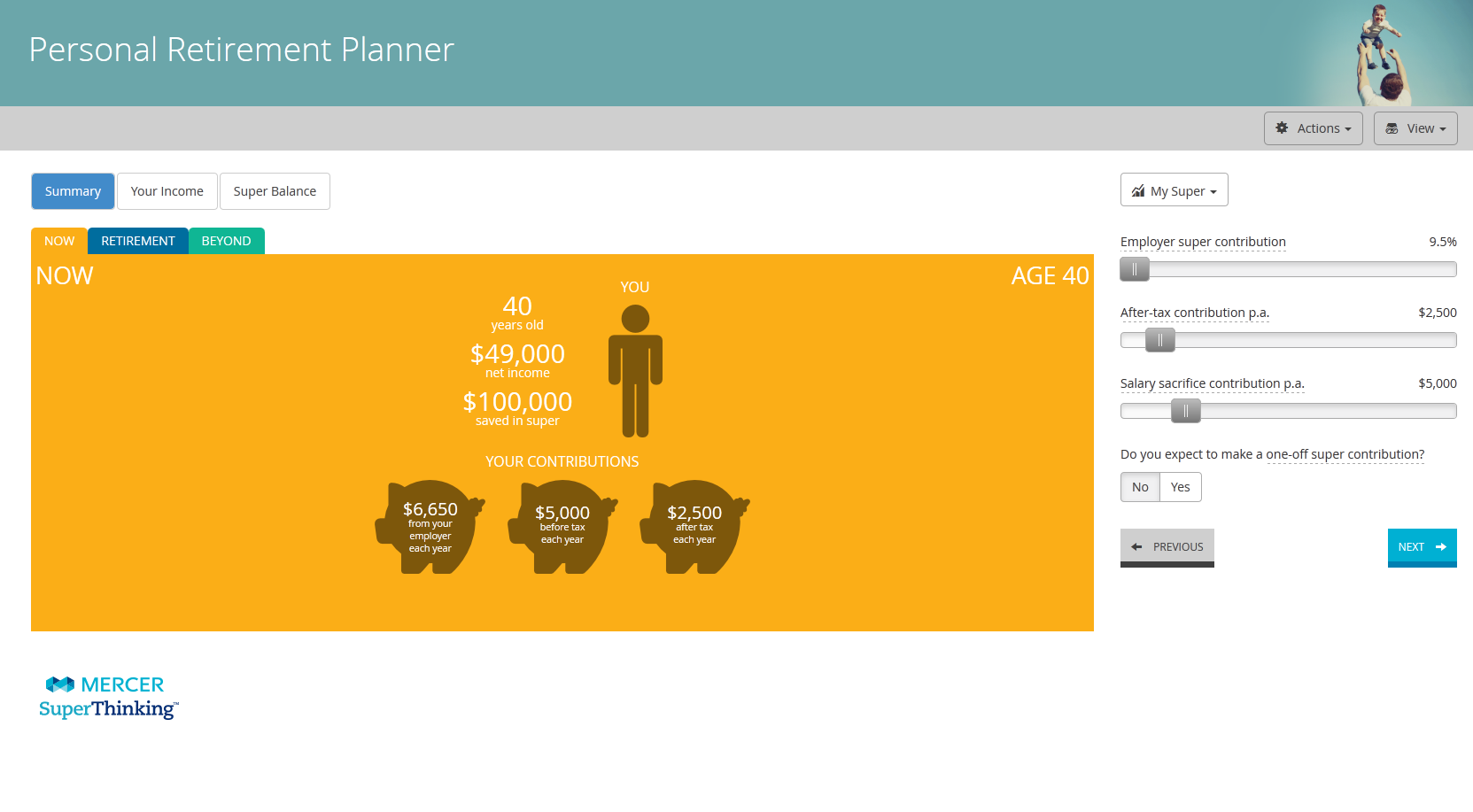

The Retirement Income Simulator is a powerful financial calculator that takes all of Mercer’s actuarial smarts and in-depth knowledge of the superannuation industry to create projections of members’ future retirement income. Projections can be delivered as part of an interactive online calculator or as a printable statement.

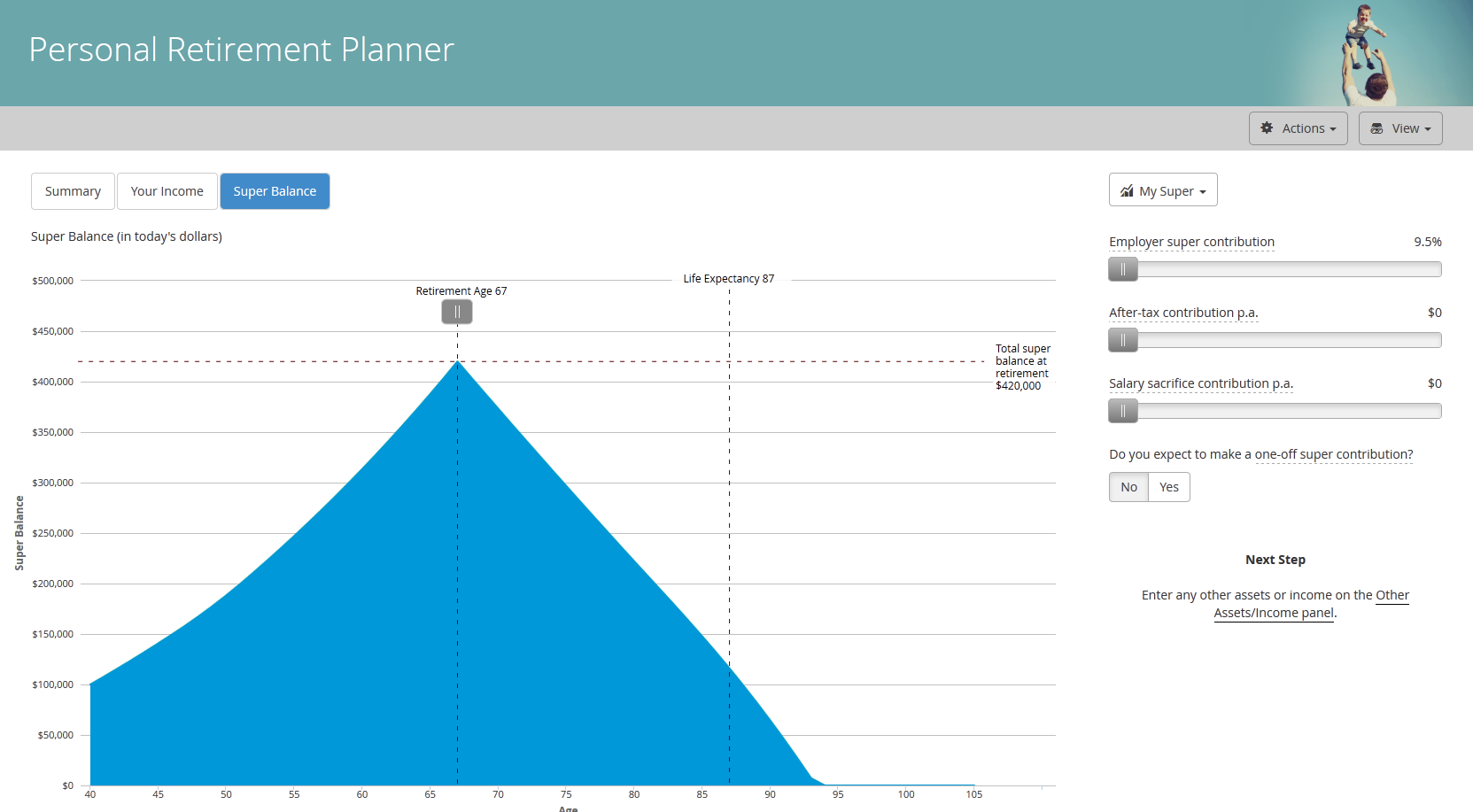

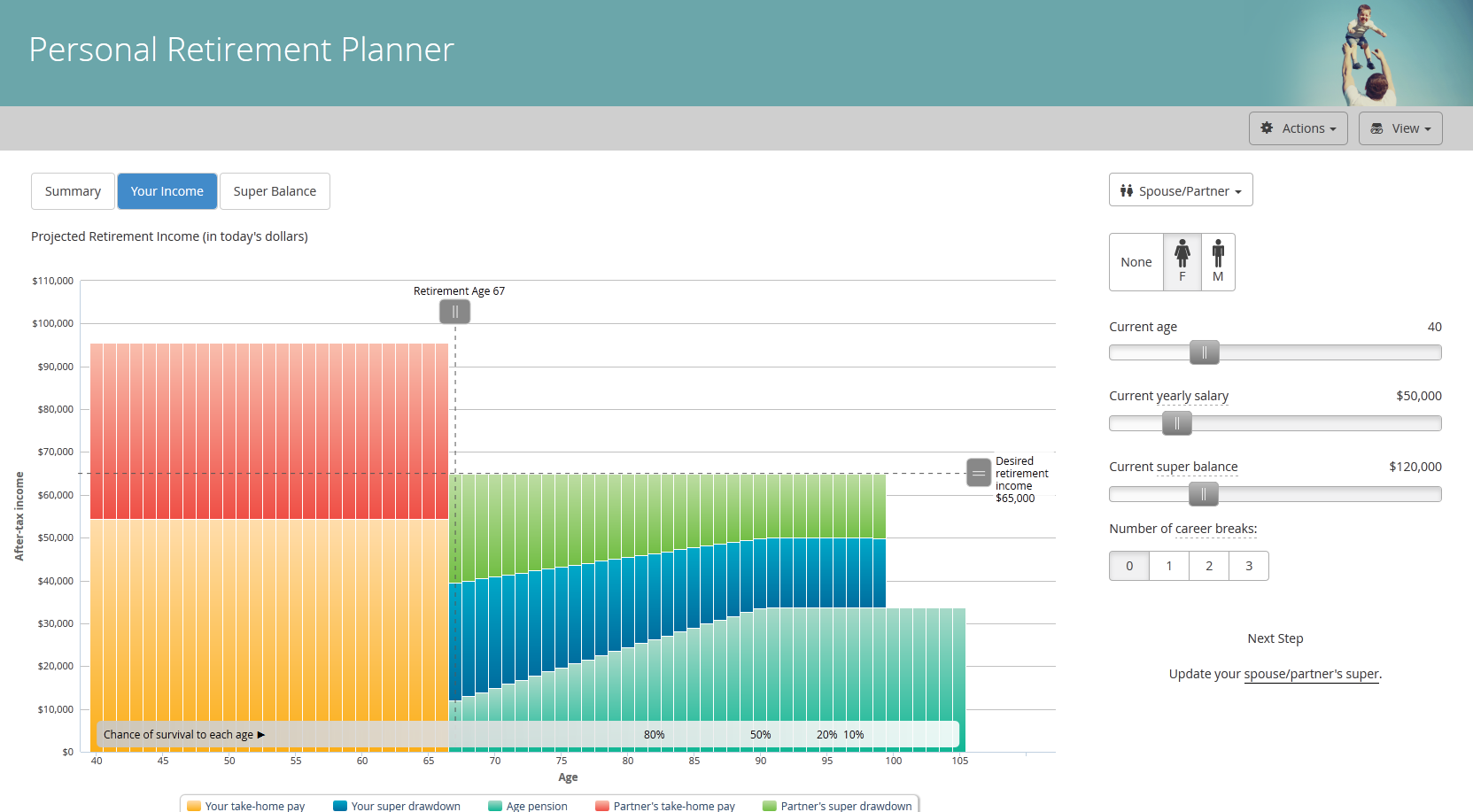

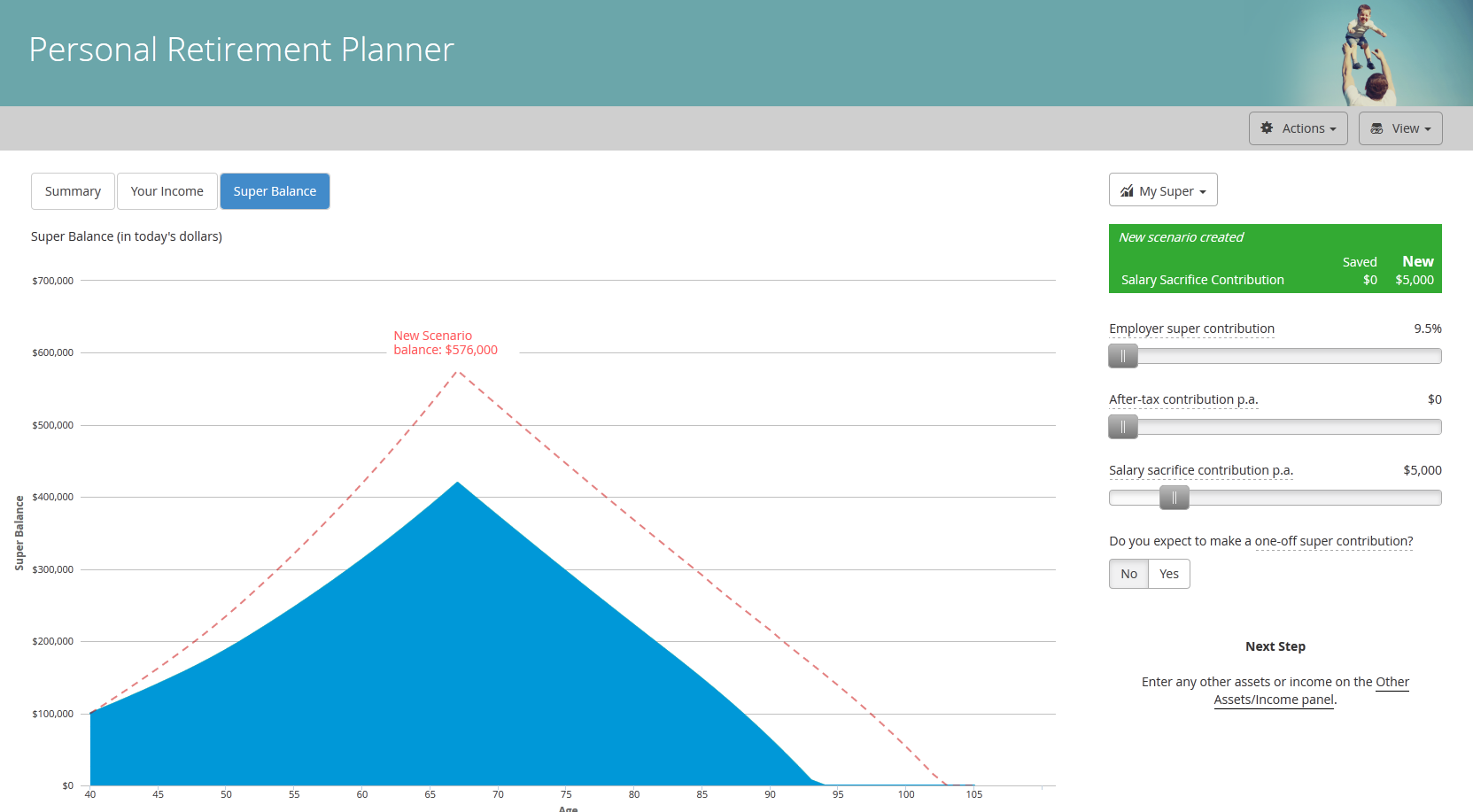

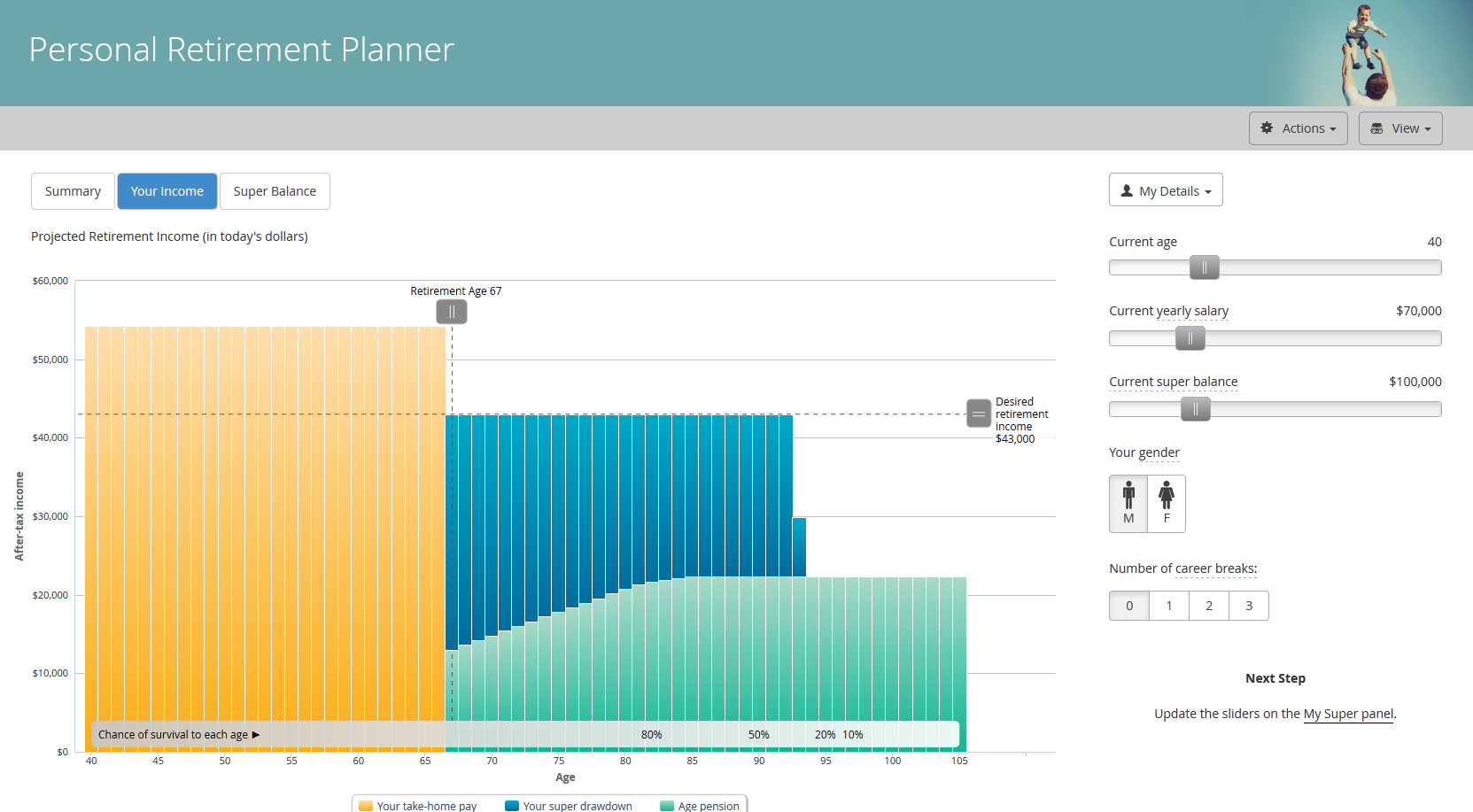

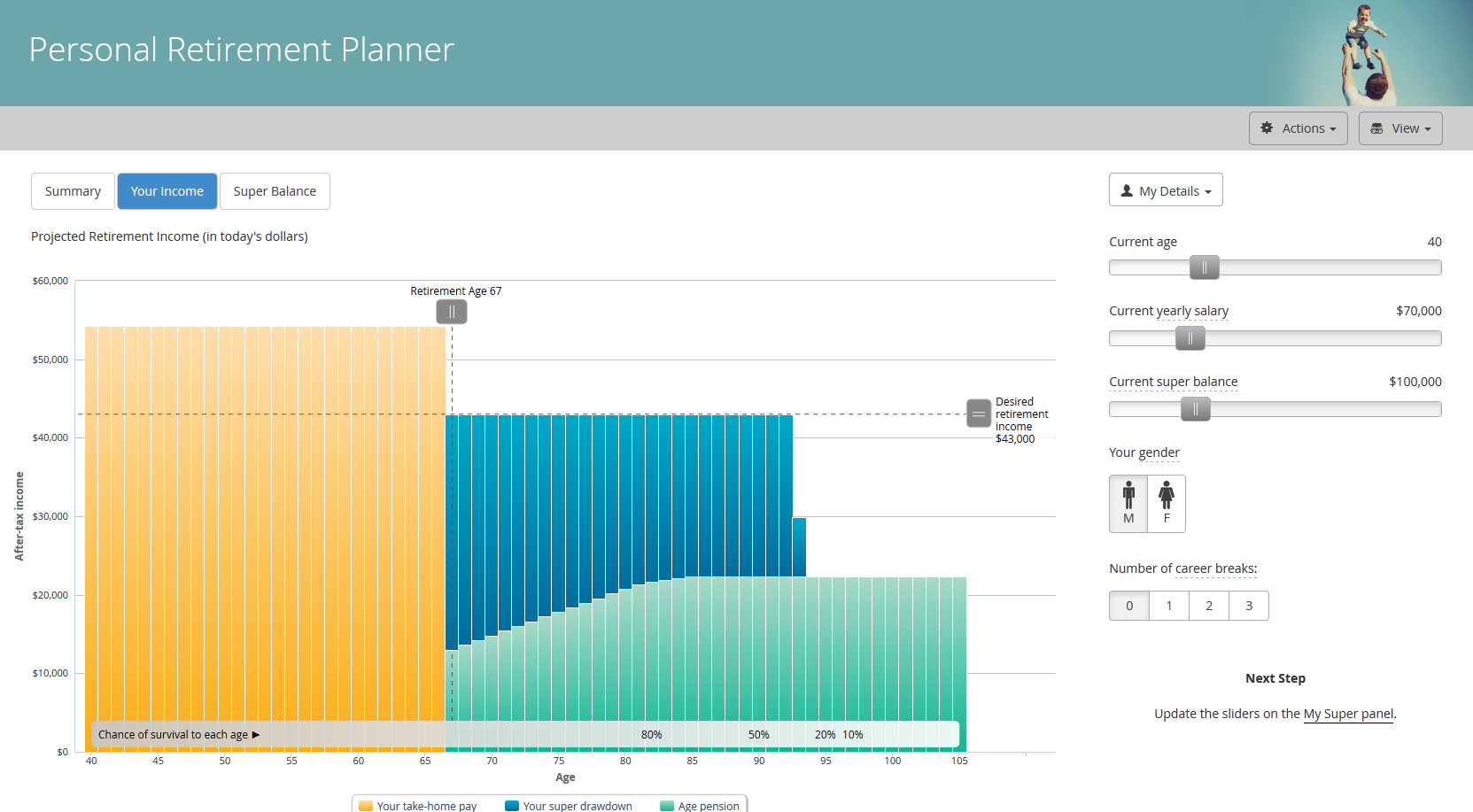

Project future income, including factors such as voluntary contributions, investment decisions, career breaks, and relationship status.

Calculate future age pension entitlements based on assets and projected income, and predict the age a member might become “age pension dependent”.

Retirement Income Simulator 9 is constantly updated with the latest changes to pension and superannuation legislation.

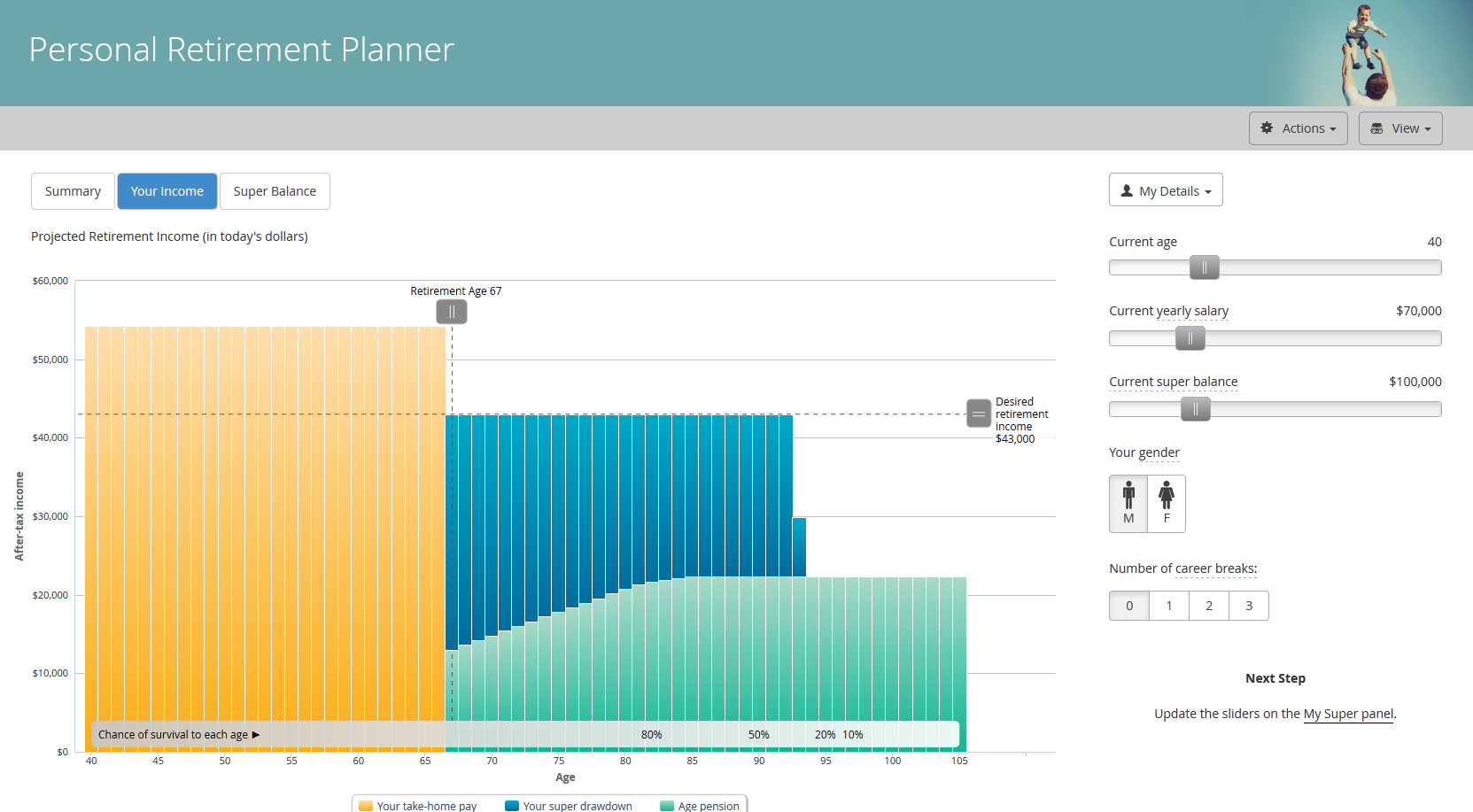

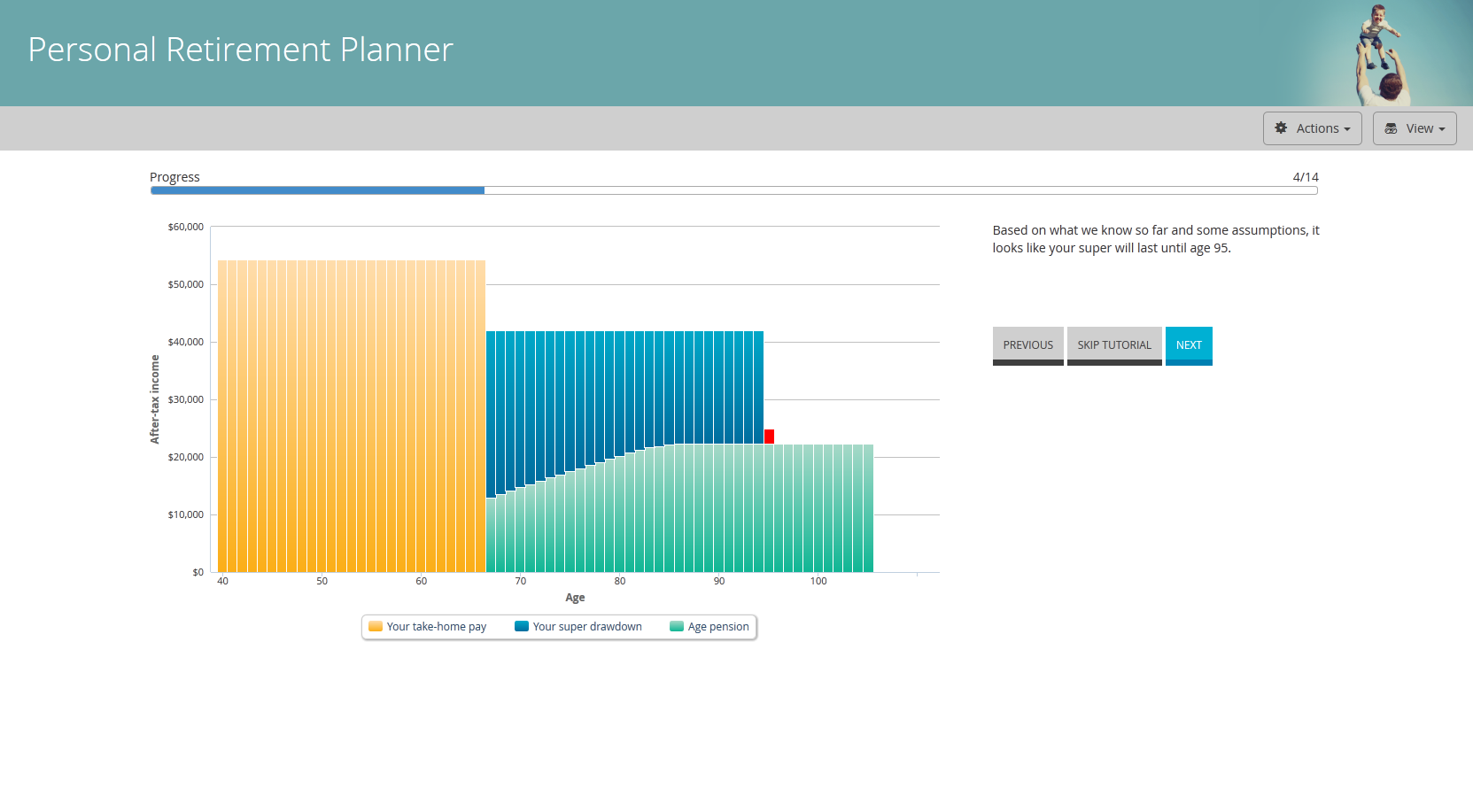

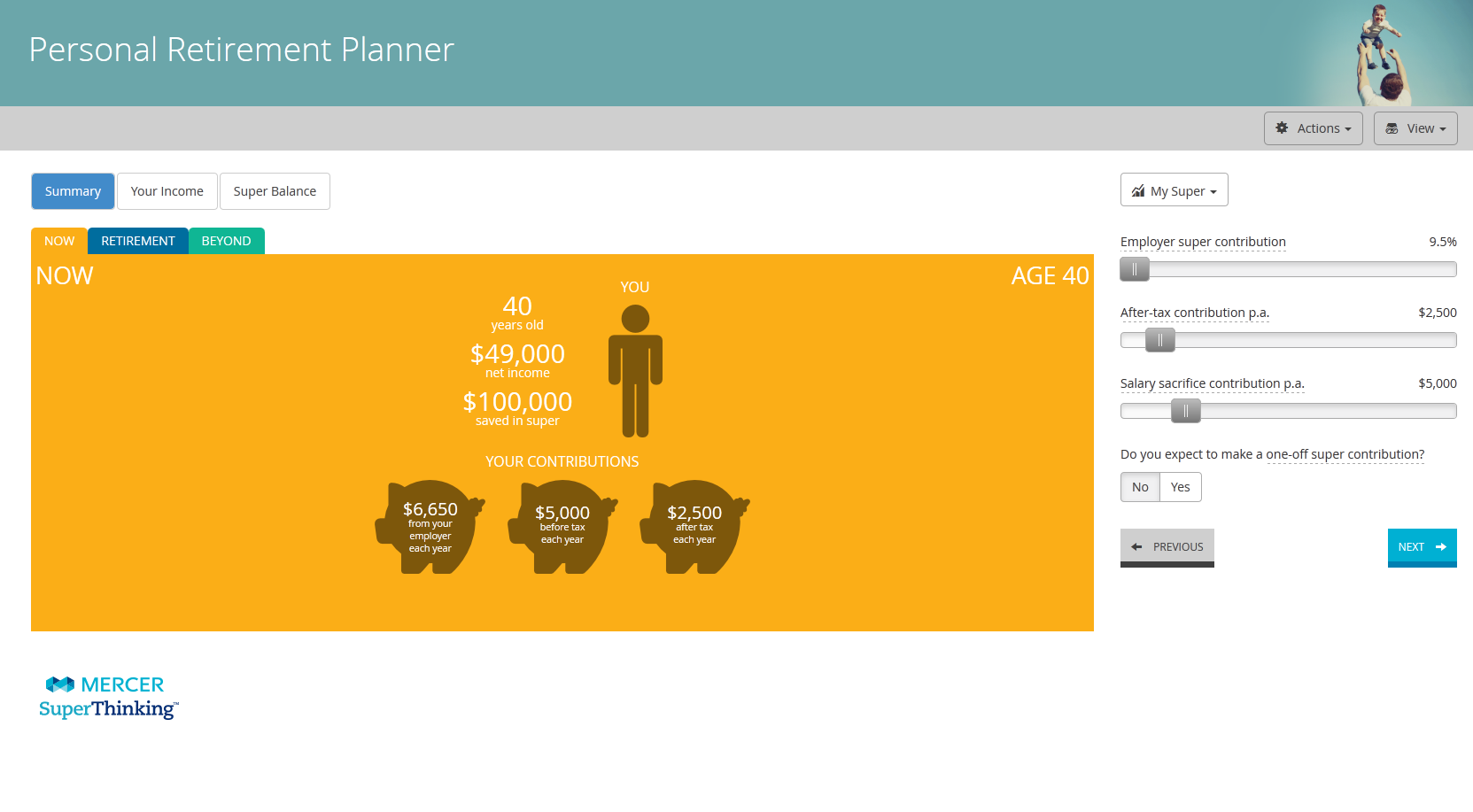

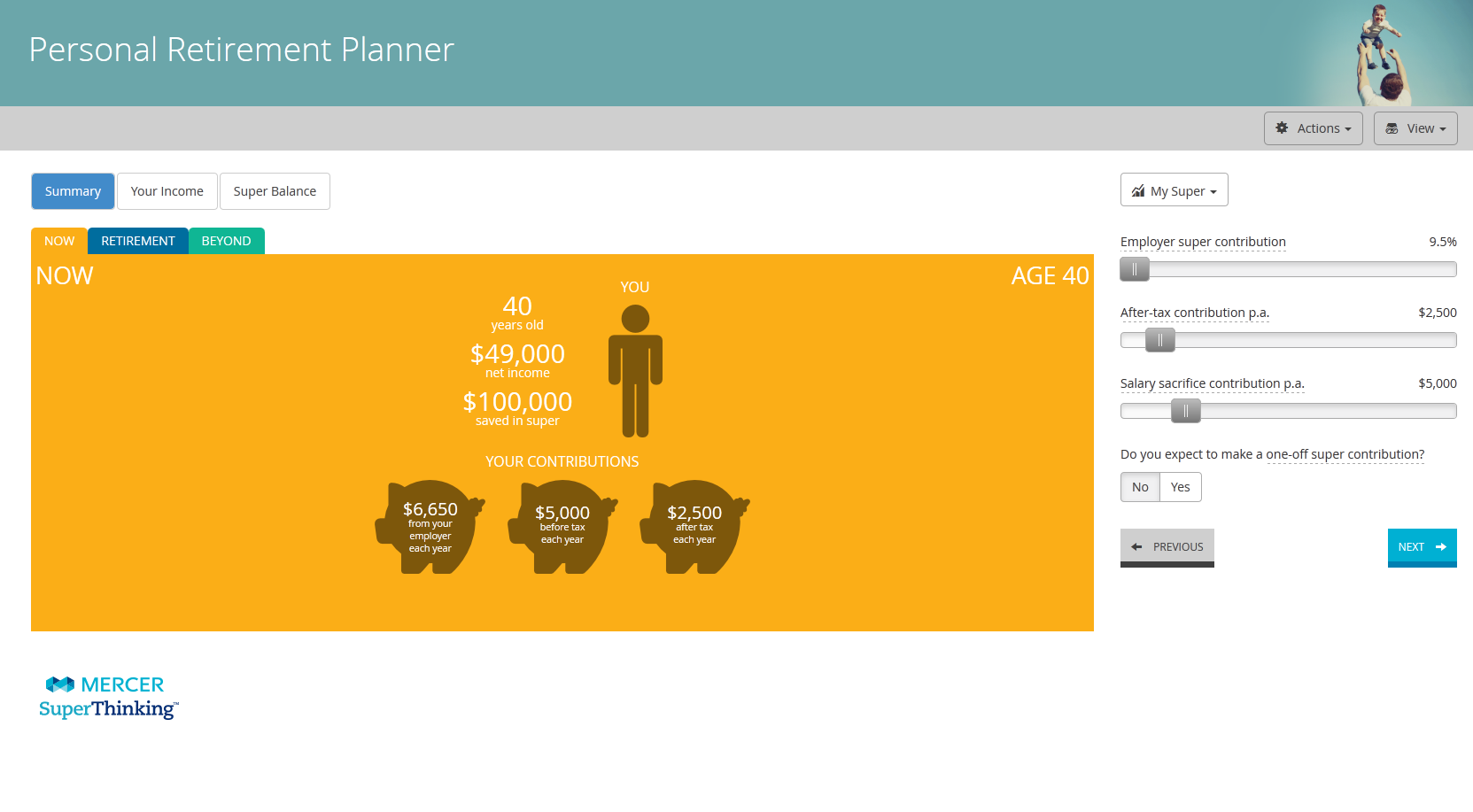

The Retirement Income Simulator online calculator gives members the ability to project their own future incomes. An intuitive user interface combined with the robust Retirement Income Simulator engine gives members the information they need to engage with their super and plan for a comfortable future.

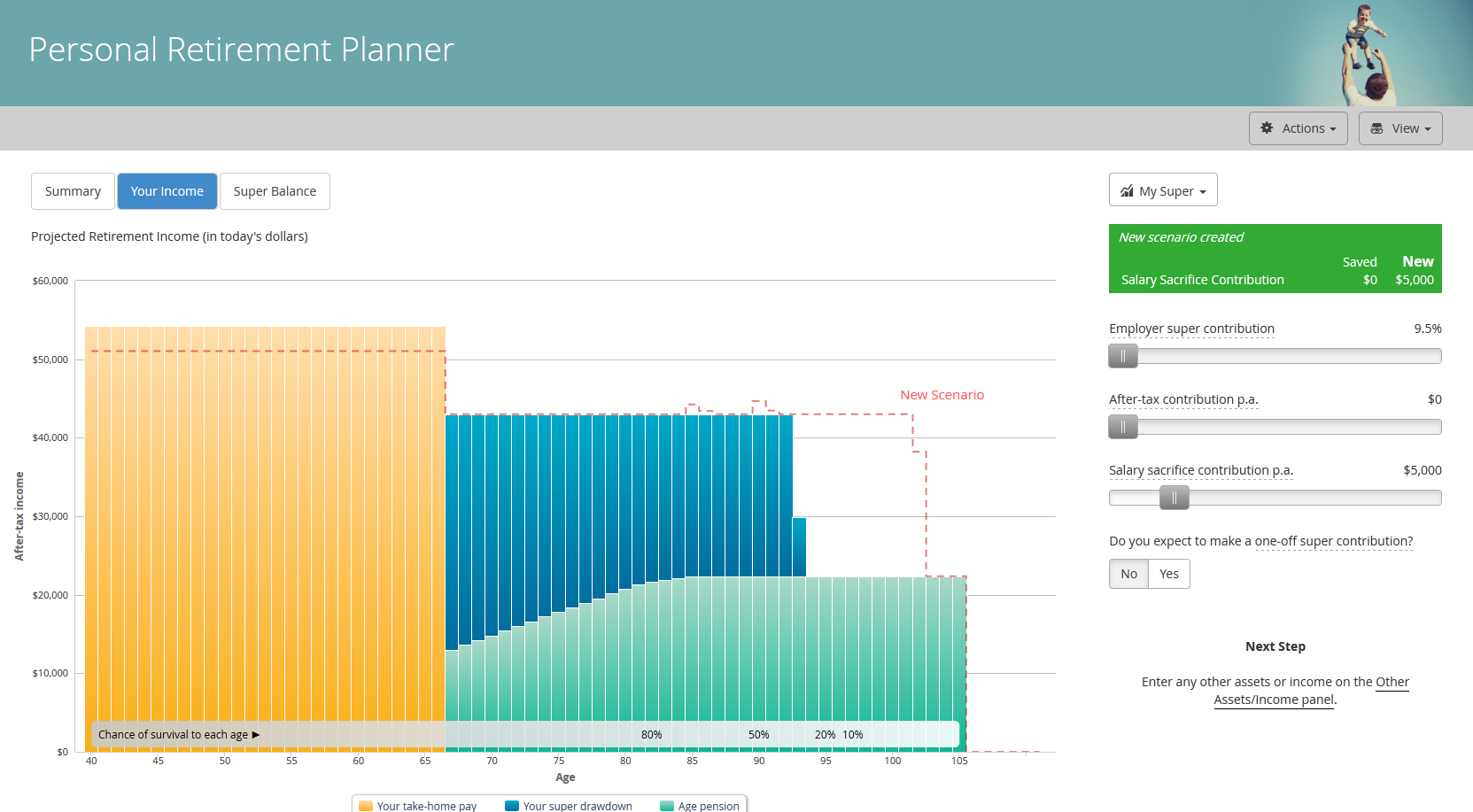

Funds can align the Retirement Income Simulator with individual member data, so it pre-populates their super details automatically.

For members who relate better to an infographic style presentation, the Simulator provides a brief text summary of their retirement projection, highlighting key figures and time periods.

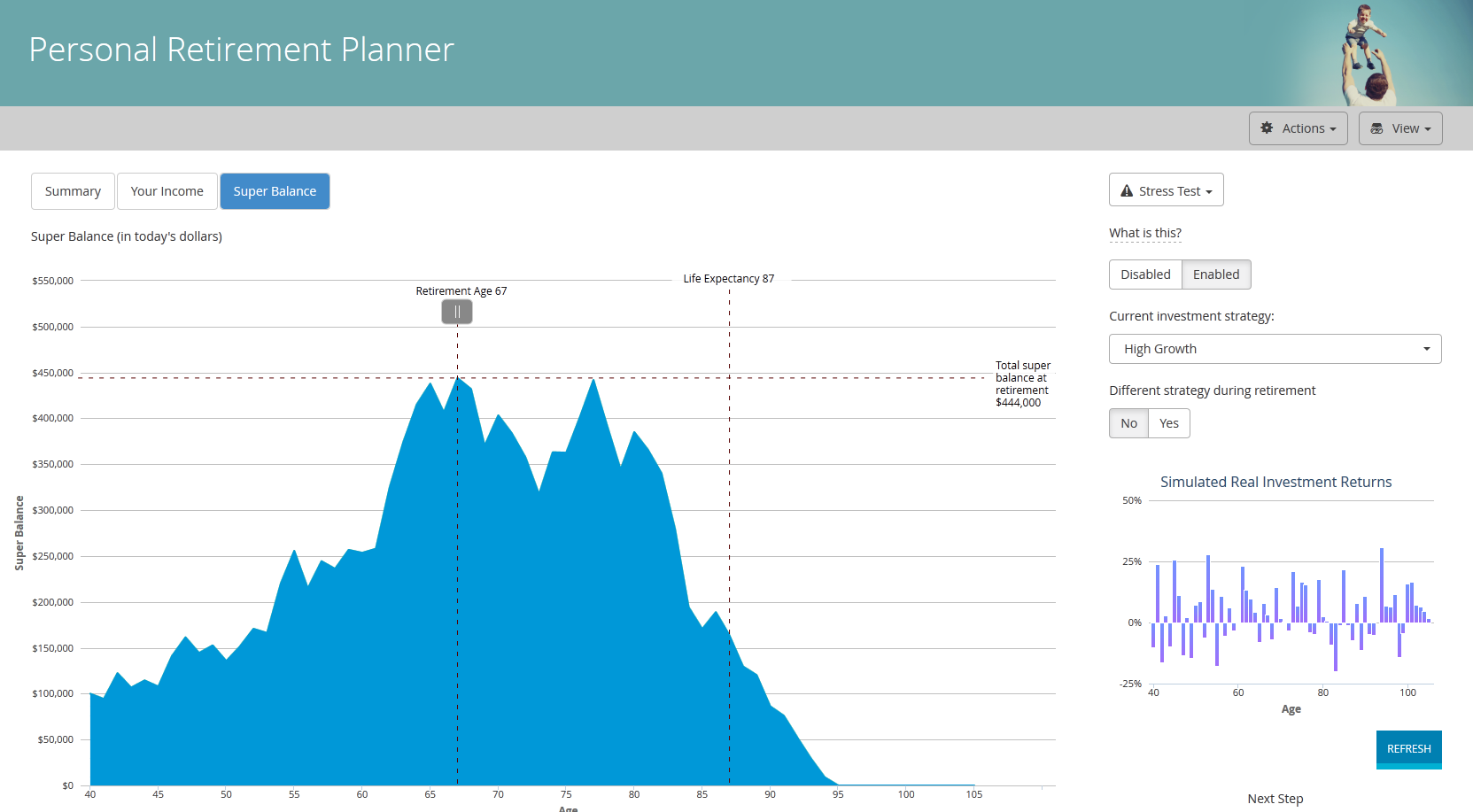

Members can explore a number of market scenarios to give them a feel for the variability of their future retirement income.

Members can save a statement based on their retirement projection, or email it to themselves for viewing later.

The Retirement Income Simulator has been reviewed and signed off by lawyers and actuaries as compliant with standards and regulations.

The Retirement Income Simulator can be customized to meet your needs. Images, colours, text, and fonts are all easily modified to match your fund’s branding.

A step-by-step tutorial guides members through using the online calculator, and explains how changing their retirement plan can impact their future.

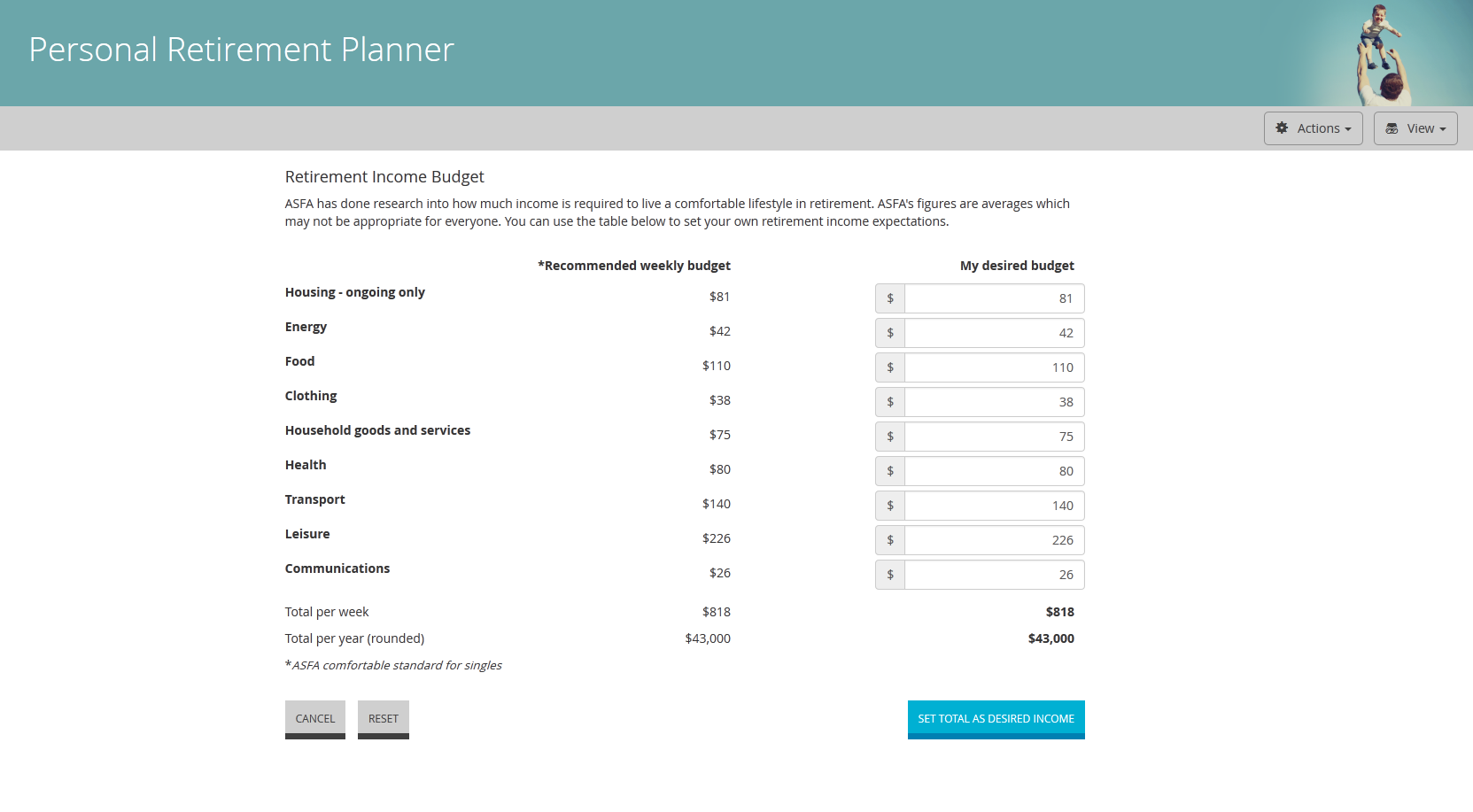

Members can estimate their desired retirement income by setting a weekly budget for various retirement needs.

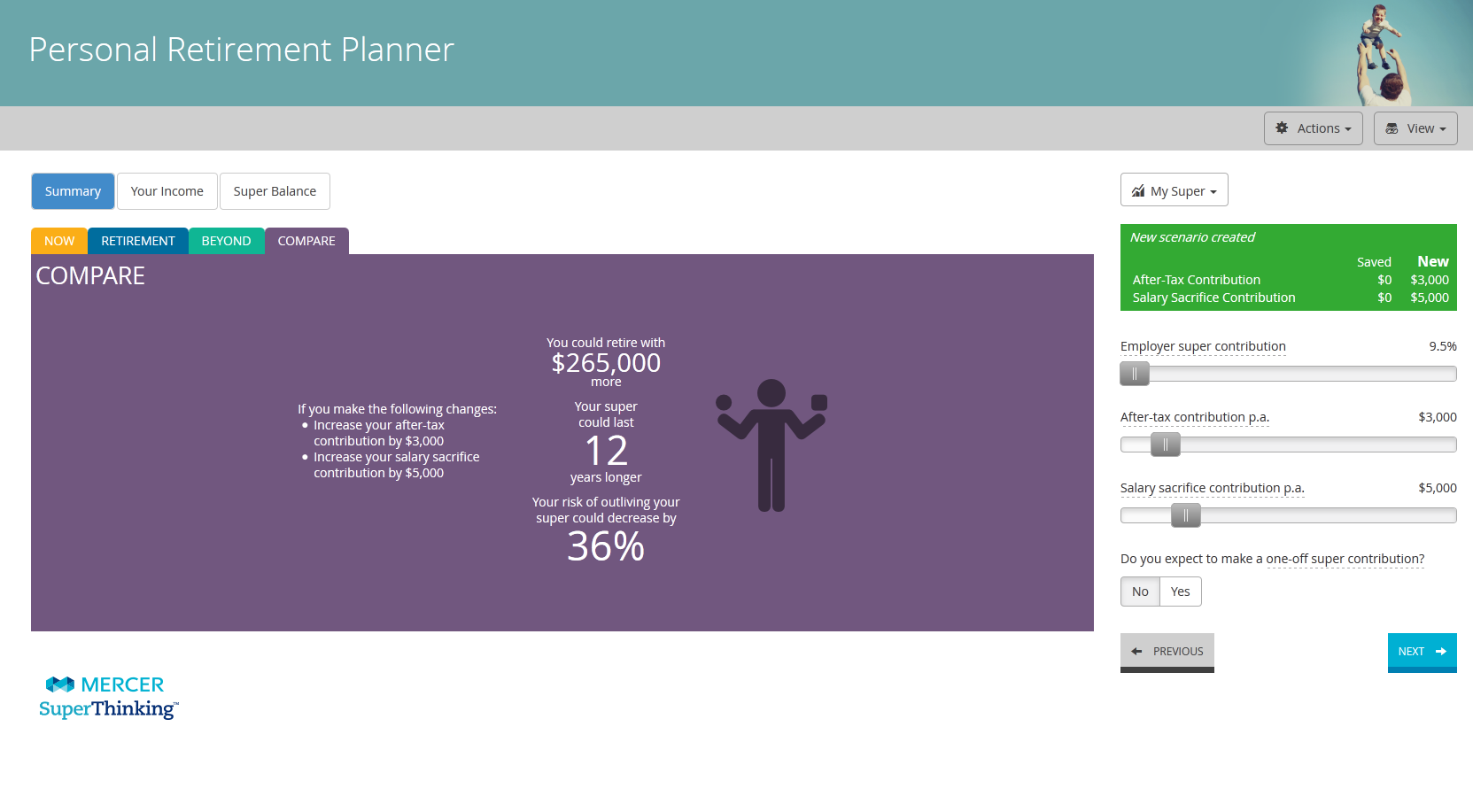

Members can compare multiple scenarios on the same chart, giving a direct visual indicator of how changes to their retirement plan impact their retirement income.

A responsive layout presents information in an optimal way for any screen size, including tablets and mobile phones.